We have already highlighted in this series that life expectancy seems to be on a never-ending upwards curve in the UK, with the possibility of living to 100 becoming more commonplace. This can easily lull us into thinking that we do not need to consider the consequences of premature death, as advances in medicine can cure most things these days.

However, whilst it makes sense to financially plan for a long and healthy life, it also makes sense to plan for the impact of one that ends prematurely. One child in 211 loses a parent by age 16, so more than one parent lost for each school class, which is a sobering statistic. My youngest son saw his classmates lose 4 parents while he was in primary school alone. One of the dad’s lost was the super-sporty, regular winner of the parent’s race at the school sports-day, all spiked running shoes, and muscles. Having a great lifestyle is not a guarantee of long life unfortunately.

We all expect to reach retirement and live a long and full life, but 1 in 52 men do not reach the age of 65. Life insurance is protecting against something that is uncomfortably more likely to happen than most people realise.

Dying is not something that we like to think about but it is something we should, and in much more detail than most people do, as the consequences of not being protected can be catastrophic. The most common life insurance scenario relates to couples with a joint decreasing life policy to cover the outstanding mortgage balance, sometimes with critical illness cover included. There seems to be a belief that if the mortgage is paid off, that equates to financial security, but does it?

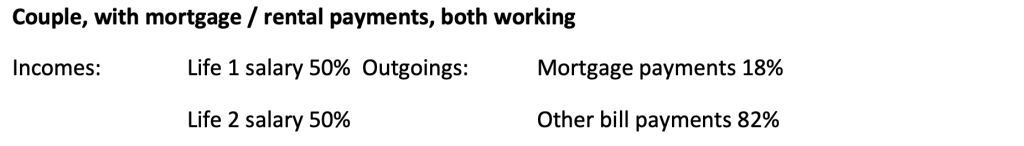

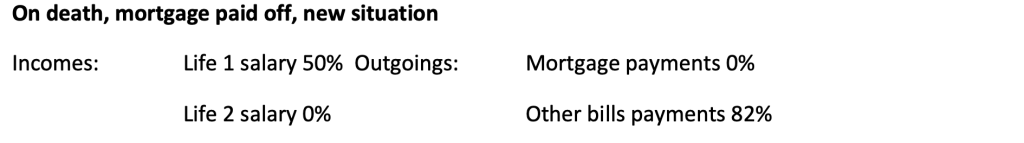

An example of the financial reality of death, based on average mortgage expenditure, is shown below:

Typical life insurance arrangement: Joint decreasing life cover to pay off mortgage loan

82% of outgoings remain, but only 50% of income remains which is not financially sustainable. If one of the couple is the dominant or only wage earner, the problem becomes more pronounced. You would expect to see some reduction in outgoings, due to one less mouth to feed and a few additional reductions, but there will be a mis match between the reduction in income to that of outgoings, leaving the remaining regular expenditure not fully covered.

So, what is the answer? Would you rely on state benefits to top up your income? That has never been a great option for most, and with the large government debt accumulated during COVID, the position is unlikely to improve.

The actual answer is additional life insurance for family protection, and you have two different options.

Option 1:

A level lump sum of cover, based on assessing the monthly income required to pay bills multiplied by 12 to give the annual cost, multiplied by the number of years the income is likely to be needed for.

e.g., £2,000/month = £24,000 p.a. over 35 years = £840,000 of cover with an indication of the monthly cost being £56* for 30yr old non-smoking couple.

Option 2:

A life insurance cover called Family Income Benefit (FIB), which pays out a regular monthly benefit on the death of the life assured, rather than a lump sum, with annual cost of living increases built in, to maintain its value over time.

Firstly, you would work out the monthly income required to pay bills and then choose the required term.

e.g., £2,000/month over 35 years, annual cost of living cover increase, with an indication of the monthly cost being £29* for 30yr old non-smoking couple.

* PLEASE NOTE THAT THESE INDICATIVE COSTS ARE PURELY FOR ILLUSTRATION, AND COSTS WILL BE DEPENDENT ON THE SPECIFICS OF THE INDIVIDUALS COVER IS BEING ARRANGED FOR AND WILL ALWAYS BE SUBJECT TO UNDERWRITING.

Comparing the two options, FIB cannot be spent too fast, be stolen, or invested badly, as it will just keep paying out until the end of the policy term, guaranteeing the cover of living expenses, and providing total peace of mind for you and your family. It is likely that there will be the bonus of the lower premiums too. One thing that must be considered when looking at FIB is the policy term, and whether cover is put in place through to the point where the children are no longer financially dependent (e.g., when they have finished university), or would cover be provided for your spouse through to retirement age.

This type of policy is not particularly well known, compared to the lump sum alternative, because not enough people think through the financial consequences of losing a partner, so do not consider the need for this protection.

The non-mortgage monthly outgoings are often viewed very differently to the monthly mortgage payment, because it has a debt attached to it, but it makes a lot of sense to look at these other payments in the same way as the mortgage payment. They are just another set of monthly outgoings that need to be covered in the event of death.

The key point here though, is when you look at life insurance needs, carefully consider two aspects, eliminating debt and replacing lost income, and make sure you take the appropriate insurance, as the reality is, you are probably betting your house on getting it right, whether you know it or not.

People often consider Critical Illness as another protection type and is commonly more recognised than FIB for example. We will provide more detail on this later in the series as the trigger for payment is if you suffer a specified life changing condition, and this does not have to be terminal, so the benefit can be used for example to pay for ongoing care, home modifications that are required for instance.

In the next post of this series, we will discuss wills, Lasting Powers of Attorney, and the rationale for ensuring you have your estate matters in order, ready for any eventuality.

Contributed by :

Warren Robins

Director – MediDent FS

Managing Director – iintegra-T

Wadm Ltd trading as iintegra-T is an Appointed Representative of Primis, which is authorised and regulated by the Financial Conduct Authority. Registered Office: Wadm Ltd, Wadm House, 34 Stourhead Drive, Northampton NN4 0UH. Registered Company Number: 11795044 Registered in England & Wales

Appendix:

1. Childhood Bereavement Network (Charity org)

2. Statistics on mortality, compiled by Men’s Health Forum, December 2014. Revised January 2017